In this comprehensive guide, [Strategies for Communicative Money Conflict Resolution: A Guide to Financial Harmony], we delve into the realm of money conflicts and provide actionable strategies for effective communication and conflict resolution. We empower couples and individuals to navigate the intricate emotional and financial landscapes that often lead to these conflicts, offering practical solutions that foster financial harmony and strengthen relationships.

Key Takeaways:

- Effective communication is essential for resolving money conflicts.

- Different communication strategies, such as active listening, using “I” statements, and focusing on solutions, can help address conflicts.

Strategies for Communicative Money Conflict Resolution

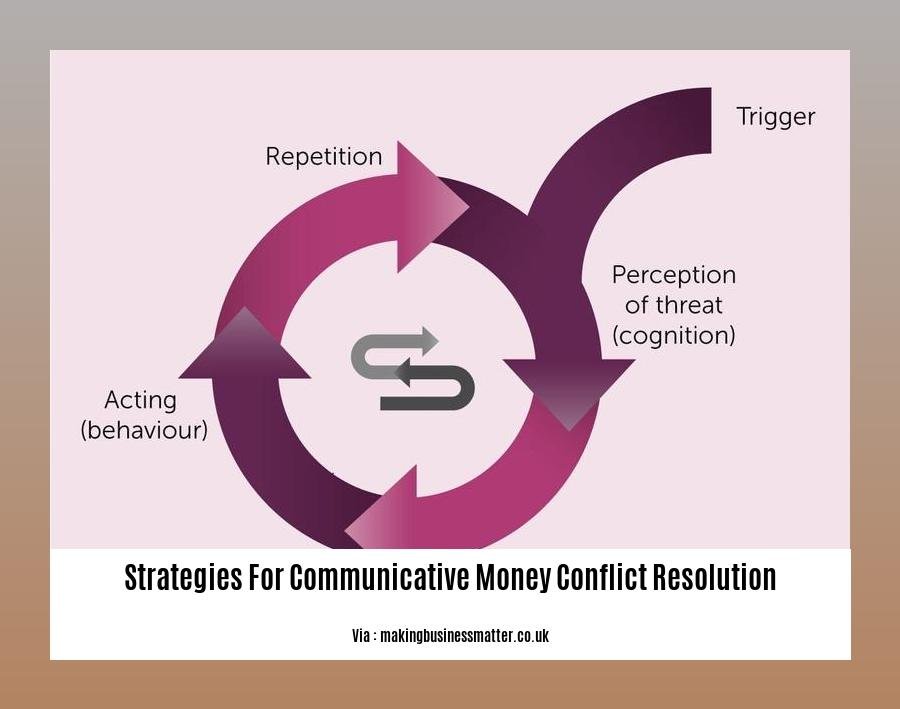

Money conflicts are a common challenge in relationships. When these conflicts arise, it’s essential to have effective strategies for communicative money conflict resolution to navigate them constructively. Here are some key strategies:

Step 1: Active Listening and Validation

- Practice active listening: Pay full attention to your partner’s concerns without interrupting or defending yourself.

- Validate their perspective: Acknowledge their feelings and viewpoint, even if you don’t agree. This shows that you understand and respect their perspective.

Step 2: Expressing Yourself Clearly

- Use “I” statements: Express your feelings and needs using “I” statements. This helps avoid blame and promotes ownership of your perspective.

- Focus on specific behaviors: Address specific money-related behaviors or actions rather than making general accusations.

Step 3: Seeking Common Ground

- Identify shared goals: Explore your financial values and goals together. Find areas where you agree or have similar concerns.

- Build on common ground: Use shared goals as a foundation for finding mutually acceptable solutions.

Step 4: Brainstorming Solutions

- Generate creative solutions: Explore various options for resolving the conflict. Be open to suggestions from both parties.

- Consider pros and cons: Weigh the potential benefits and drawbacks of each proposed solution.

Step 5: Negotiating and Compromising

- Be willing to negotiate: Recognize that both parties may have to compromise to reach a solution.

- Find mutually acceptable terms: Work together to find an agreement that meets the needs of both partners as much as possible.

Step 6: Setting Agreements and Expectations

- Document the agreement: Clearly outline the terms of the agreement in writing or verbally to avoid misunderstandings later.

- Set clear expectations: Establish specific actions and responsibilities for each partner to promote accountability.

Step 7: Monitoring and Re-evaluation

- Regularly check in: Review the agreement periodically to ensure it’s still working effectively.

- Be open to adjustments: If the agreement is not meeting its intended purpose, be willing to revisit and make changes as needed.

By implementing these strategies for communicative money conflict resolution, you can create a safe and open dialogue, foster understanding, and find mutually acceptable solutions that strengthen your financial relationship.

If you and your partner have different financial goals and you can’t get on the same page about money, here are some tips for communicating financial goals and decisions as a couple. Is it possible to be financially compatible with someone who is wired differently than you? Here are some tips for having open honest discussions about finances and aligning on the same tips for getting on the same page about money as partners. Openly discuss your financial plans and priorities – both as individuals and as a team. Here are some ways to openly discuss financial plans and priorities.

Use “I” Statements to Express Your Own Feelings and Needs

When conflicts arise between partners regarding financial matters, open and constructive communication is crucial. “I” statements are a powerful tool to facilitate this effective communication. They enable individuals to express their feelings and needs without blaming or accusing their partner.

By starting with “I,” you:

- Take ownership of your emotions and experiences.

- Avoid blaming your partner, which can escalate conflicts.

- Create a space for respectful dialogue and understanding.

Steps to Use “I” Statements:

- Identify your feelings and needs.

- Use specific language to describe your experience.

- Avoid generalizations or accusations.

- Express your thoughts in a clear and concise manner.

Example:

Instead of saying: “You spend too much money,” try “I feel concerned when we exceed our budget.”

Key Takeaways:

- “I” statements promote personal responsibility for feelings.

- They foster open and respectful communication.

- By avoiding blame, they create a foundation for finding solutions.

- Using specific language ensures clarity and understanding.

Additional Resources:

Seek Common Ground and Brainstorm Options for Resolution

Navigating money-related conflicts within a relationship requires an open and communicative approach. Here are some strategies to effectively reach resolutions:

Find Shared Goals

Identify common financial objectives, values, or concerns that can serve as a foundation for finding solutions.

Brainstorm Solutions Together

Engage in a non-judgmental brainstorming session where you both contribute ideas. Explore different options, consider their potential benefits and drawbacks, and prioritize those that align with your shared goals.

Negotiate and Compromise

Recognize that compromises are often necessary. Be willing to adjust your expectations and find mutually agreeable terms that accommodate both perspectives.

Set Clear Expectations and Agreements

Document any agreements reached to ensure clarity and prevent misunderstandings. Define responsibilities, timelines, and financial boundaries.

Monitor Progress and Make Adjustments

Regularly check in to assess the effectiveness of the solutions implemented. If adjustments are needed, revisit the situation and work together to modify the plan.

Key Takeaways:

- Define the root cause of the conflict and identify specific needs.

- Look for areas of agreement and use them as a starting point for finding solutions.

- Explore multiple options and consider their pros and cons.

- Be willing to compromise and negotiate to reach mutually acceptable terms.

- Set clear expectations and agreements to prevent misunderstandings.

- Monitor progress and make adjustments as needed.

URL Source:

Managing Conflict Resolution Effectively: Psychology Today

Negotiate, Compromise, and Set Clear Expectations for the Solution

Navigating money conflicts within relationships requires open dialogue, compromise, and clear expectations. Here’s a guide to help you resolve these conflicts effectively:

Negotiate

- Identify areas where you can negotiate and be willing to give and take.

- Focus on shared goals and finding solutions that meet both your needs.

- Use “I” statements to express your feelings and desires respectfully.

Compromise

- Understand that you may not always get exactly what you want.

- Be prepared to compromise and find a middle ground that satisfies both parties.

- Prioritize the most important aspects and be willing to negotiate on less important ones.

Set Clear Expectations

- Once you’ve reached an agreement, set clear expectations for how you will implement the solution.

- Discuss who is responsible for what and establish a timeline for action.

- Document the agreement in writing or verbally to avoid misunderstandings in the future.

Key Takeaways:

- Active listening and empathy are crucial for understanding your partner’s perspective.

- Communicate your needs and feelings clearly, using “I” statements.

- Explore options and brainstorm solutions together to find a mutually acceptable outcome.

- Negotiate and compromise to reach a solution that meets both your needs.

- Set clear expectations to avoid future misunderstandings.

- Regularly review and adjust the agreement as needed to ensure it’s working effectively.

Most Relevant URL Source:

- Strategies for Communicative Money Conflict Resolution