Unlocking the Secrets to Financial Harmony: Practical Ways to Openly Discuss Financial Plans and Priorities

Key Takeaways:

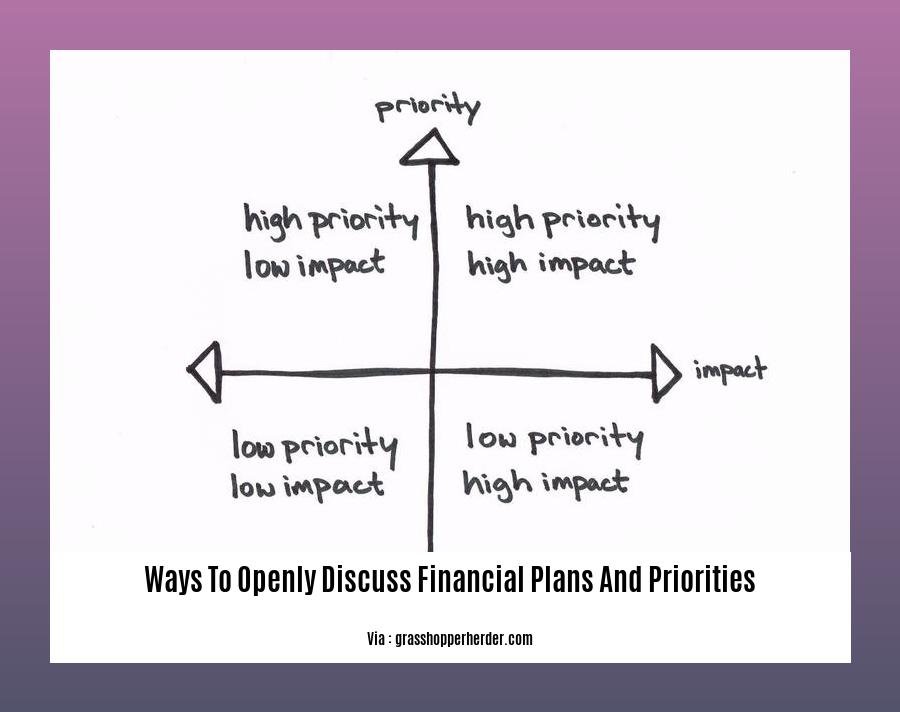

- Define and prioritize your financial goals.

- Set specific and measurable goals to track your progress.

- Utilize online tools for budgeting, evaluating priorities, and designing the best financial strategy.

Ways to Openly Discuss Financial Plans and Priorities

Preparing one’s financial plans and priorities is essential to reach long-term financial goals. Yet, having open and honest conversations about these plans can often feel daunting. Here are effective ways to initiate these discussions:

Set a Conducive Environment

- Choose a private and comfortable setting: Discuss financial matters in a place where you both feel relaxed and can speak openly without distractions.

- Schedule a specific time: Dedicate a designated time for financial discussions to ensure that both parties are fully present and engaged.

- Start with small, non-threatening topics: Begin by discussing general financial habits or financial news to ease into the conversation and build a comfortable atmosphere.

Communicate Clearly and Honestly

- Be transparent about your financial situation: Share your income, assets, debts, and financial goals openly. This builds trust and allows for a more informed discussion.

- Listen actively: Pay attention to your partner’s perspective, values, and financial concerns. Show that you understand their point of view by reflecting on their statements.

- Avoid accusatory language: Use “I” statements to express your feelings and concerns. For example, instead of saying “You always overspend,” try “I feel concerned when I see our spending exceeding our budget.”

Establish Joint Financial Goals

- Identify shared financial priorities: Discuss what’s important to both of you and work towards achieving those goals together.

- Create a budget together: Develop a realistic budget that aligns with your joint financial goals and constraints.

- Establish accountability mechanisms: Set up systems for tracking your progress and making adjustments as needed.

Seek Professional Help if Necessary

- Consider consulting a financial advisor: A certified financial advisor can provide objective guidance, help you develop a comprehensive financial plan, and facilitate discussions.

- Attend financial workshops: Educational workshops can provide valuable information and strategies for managing finances and achieving financial goals.

Remember, open and honest financial conversations are crucial for building financial security and a thriving relationship. By implementing these strategies, you can create a shared understanding, set realistic goals, and work together towards a financially fulfilling future.

For effective financial management and harmony in a relationship, it’s crucial to seamlessly communicate financial goals and decisions as a couple. Open and honest discussions can help you align your aspirations and make informed choices together.

To foster a shared understanding about money matters, consider implementing tips for getting on the same page about money as partners. These include setting up regular financial check-ins, creating a joint budget, and discussing your financial values and priorities.

Additionally, having constructive communication strategies in place is essential for resolving financial conflicts amicably. Explore strategies for communicative money conflict resolution to learn how to approach disagreements respectfully, listen actively to each other’s perspectives, and find mutually agreeable solutions.

Actively listen to each other’s perspectives and seek to understand.

In any conversation, the most important thing is often just to listen. We gain so much more from truly hearing what someone else has to say, especially when it comes to something as significant as finances.

When you start to have open and honest conversations about money, make it a priority to actively listen to each other’s perspectives and seek to understand. Don’t just wait for your turn to talk; instead, really take the time to hear what the other person is saying, both verbally and nonverbally. When you listen, you’re showing that you care about what they have to say.

Here are a few tips for active listening:

- Pay attention to what the other person is saying.

This means looking at them, making eye contact, and nodding appropriately. - Don’t interrupt.

This can be hard, but it’s important to let the other person finish their thought. - Ask clarifying questions.

This shows that you’re engaged in the conversation and that you want to understand. - Summarize what the other person has said.

This helps to ensure that you’ve understood them correctly. - Be empathetic.

Try to put yourself in the other person’s shoes and understand their point of view.

Key Takeaways:

- Active listening is a critical skill for any relationship, but it is especially important when discussing finances.

- When you actively listen, you are showing the other person that you care about what they have to say.

- Active listening can help to build trust, resolve conflicts, and make communication more effective.

Source:

The Importance of Active Listening

Be prepared to compromise and negotiate when necessary.

When negotiating a contract with a client, it’s crucial to be prepared to compromise and negotiate as and when necessary. Remember, each party involved in the negotiation has their objectives, interests, and limitations, and finding a mutually acceptable solution requires willingness from both sides to adjust their positions.

Here’s how you can approach negotiations with a mindset of compromise and negotiation:

-

Set realistic expectations. Don’t expect to get everything you want in the negotiation. Be prepared to give and take, and focus on finding a solution that meets the needs of both parties.

-

Be willing to walk away. If the negotiation isn’t going anywhere or if you’re not comfortable with the terms, be prepared to walk away. Having a strong BATNA (Best Alternative to a Negotiated Agreement) will give you the confidence to do so.

-

Focus on building a relationship. Negotiations are not just about getting the best deal. It’s also about building a relationship with the other party. Be respectful, listen to their concerns, and try to find common ground.

-

Be creative. Don’t be afraid to think outside the box and come up with creative solutions that meet the needs of both parties.

-

Be patient. Negotiations can take time. Don’t get discouraged if you don’t reach an agreement right away. Be patient and persistent, and work towards finding a solution that works for everyone.

Key Takeaways:

- Be prepared to compromise and negotiate as and when necessary.

- Set realistic expectations.

- Be willing to walk away if the negotiation isn’t going anywhere or if you’re not comfortable with the terms.

- Focus on building a relationship with the other party.

- Be creative and come up with solutions that meet the needs of both parties.

- Be patient and persistent.

Source:

Forbes: Negotiating A Contract With A Client? Here Are 9 Best Practices

Regularly Review and Adjust Financial Plans as Needed

Key Takeaways:

- Maintaining financial health requires regular plan reviews to ensure alignment with evolving goals and objectives.

- Evaluate budgets, reassess goals, and compare situations to identify areas for improvement.

- Timely adjustments to financial plans enhance long-term success by considering life changes and financial circumstances.

- Bi-annual or annual reviews are recommended, but significant life events warrant more frequent revisions.

Through regular reviews, you can stay on top of your financial situation and make necessary adjustments to ensure that you are on track to meet your financial goals. By following these tips, you can take control of your finances and set yourself up for financial success.

Citation:

– Financial Plan Review | Definition, Key Components, & Benefits